Using AI To Effectively Discover Liquidity in the US Corporate Bond Market

The US corporate bond market is estimated to have $46T outstanding yet less than $40B trades in the secondary market each day, accounting for less than 10 bps. In contrast, US equities have a similar $49T market cap but have a significantly higher $550B average daily dollar volume – more than 10 times average daily notional value.1 Even though corporate secondary trading has grown in recent years, as measured by TRACE, it has lagged the exponential growth in new issuance. Consequently, secondary trading has become less liquid as measured as a percent of the overall outstanding debt market.

Recently noted

“ For the past decade … with balance sheet less available, working a trade more often entails the liquidity provider tapping their client network in hopes of finding someone that is interested in doing the opposite of what the order-placer is doing: a seller for the buyer or a buyer for the seller. If this sounds like finding a needle in a haystack, it essentially is.” 2

– Kevin Mcpartland Of Coalition Greenwich

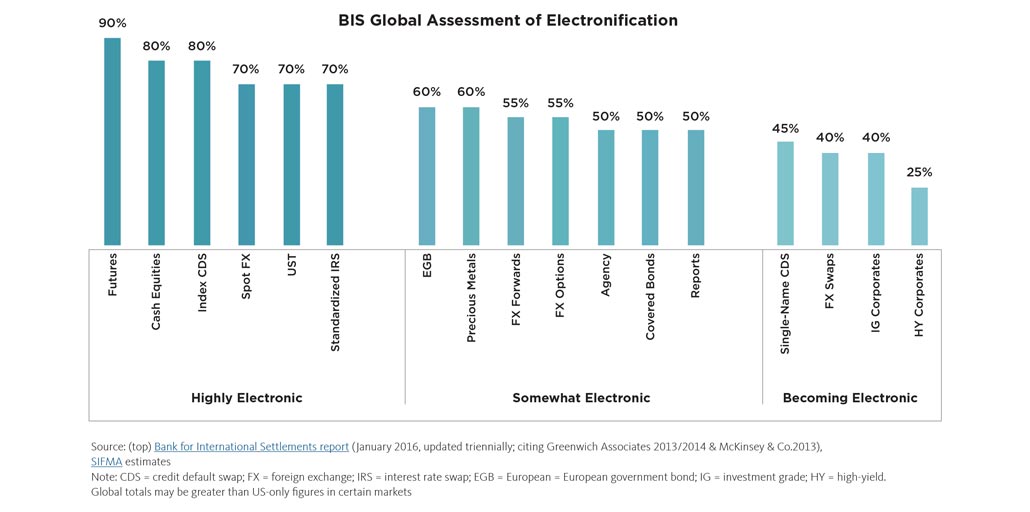

The increasing electronification of corporate bond trading will allow for more efficiency, but the move to electronic platforms has lagged other asset classes and products. In this whitepaper, we discuss some of the challenges corporate bond market participants face in light of the lack of both liquidity and transparency, and how electronification, data science and a new trading protocol can help.

Note: CDS = credit default swap; FX = foreign exchange; IRS = interest rate swap; EGB = European = European government bond; IG = investment grade; HY = high-yield.

Global totals may be greater than US-only figures in certain markets

LOCKED BONDS

This absence of liquidity can be measured by the percentage of bonds that trade vs. those that don’t. The majority of bonds that trade have been recently issued (or “on the run”) vs. less-recently issued (or “off the run”) bonds. On average, 80% of the trading activity is from 20% of the outstanding debt issues, or just from those “on the run issues.” Because of this lack of liquidity, most investment professionals have a large percentage of their portfolios in “locked bonds.” There is no ability for them to execute transactions to natural buyers or sellers at market-clearing levels in those securities in the current market structure.

TIME LOST TO PORTFOLIO RECONSTRUCTION

Today many portfolio managers embrace advanced OMS platforms for the purpose of portfolio construction, rebalancing and indexing. However, while these tools are sophisticated and powerful, they often lack the ability to assess the probability that a trade can be executed in the market. As a result, portfolio managers spend significant time creating trades they would like to do, only to find insufficient liquidity to get the trades done at their target prices. Research by LTX has shown that many portfolio managers experience this occurrence in more than half of their daily trading activities.

DIFFICULTY SOURCING LARGER TRADES

While current electronic FI trading platforms have increased in usage, accounting for nearly 40% 3 of overall corporate bond trading, this electronic share significantly lags that of other asset classes. Moreover, the existing platforms are only considered useful for smaller-sized trades. Finding sufficient liquidity to execute larger transactions may require the ability to discover natural liquidity across multiple counterparties while minimizing information leakage to prevent market disruptions.

POOR PRICE DISCOVERY AND PRICING

In US corporate bond trading, as an over-the-counter market with no central limit order book nor a requirement for real-time reporting of executed trades, price discovery is difficult – sometimes impossible. Moreover, the lack of market-wide price discovery adds to already sparse liquidity conditions as buyers and sellers disagree on the fair price for many bonds. These two dynamics--low liquidity and poor price discovery--often combine to cause significant market impact and poor pricing for firms looking to buy or sell bonds.

USING AI TO DISCOVER CORPORATE BOND LIQUIDITY

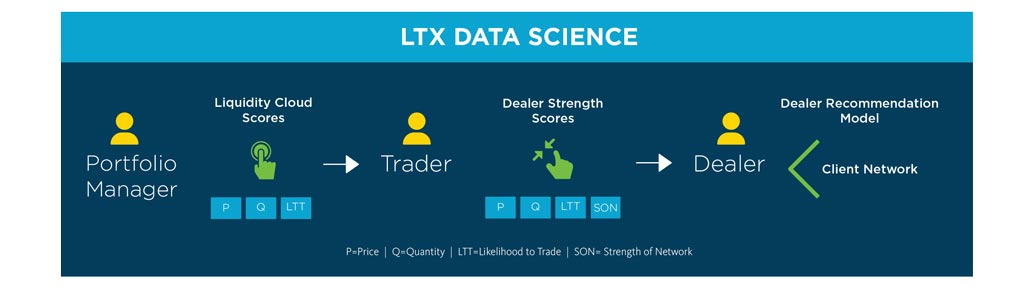

LTX uses proprietary data science techniques to analyze thousands of indications in its Liquidity Cloud® to produce Liquidity Cloud Scores. These metrics are designed to help portfolio managers understand real-time liquidity and inform traders when to transact. Both buy-side and sell-side market participants are empowered to share intentions, anonymously and securely, into the Liquidity Cloud as to what they are trying to get done. The Liquidity Cloud Scores update dynamically to reflect changes in liquidity conditions and, more importantly, provide insights into the likelihood of getting any trade done based on the priorities other participants have shared in the Liquidity Cloud. Given the unique dynamics of the OTC bond market, users can set alerts so they are notified immediately when there is potential liquidity to trade. Automatically delivering this information creates a model of efficiency, allowing traders and portfolio managers to focus on macro tasks and strategies. Further, in today’s RFQ world, the only way to assess liquidity is to ask a dealer, creating information leakage. The Liquidity Cloud provides the buy-side with the ability to assess liquidity without asking anyone.

Measuring real-time liquidity is a big step forward, but making the pre-trade information actionable is essential. LTX provides users with information to assist them in choosing the best-equipped dealer to connect with the natural contra interest in the Liquidity Cloud. That dealer is enabled to ensure that all interested buy-side participants in their client network are invited to the trade. LTX makes this possible with dynamic Dealer Strength Scores, which assist buy-side firms in deciding which dealer to send the order to, and AI tools, which help the dealer identify and invite their most interested buy-side participants to the trade. As a result, the likelihood of the trade being done at the target price or with price improvement is maximized, while information leakage is minimized.

DEALER STRENGTH SCORES

Most buy-side market participants emphasize the importance that dealers play in the corporate bond market. But which dealer is most likely to get any trade done, which can get it done fastest, with the least market impact or even provide price improvement is very difficult to know. Dealer Strength Scores assist buy-side traders with choosing one of the dealers for any trade based upon data. Taking into account information such as the dealer’s past performance with trades like the one being considered and the strength of the dealer’s network for this particular trade, the LTX Dealer Strength Score provides traders with an objective tool to quickly choose a dealer.

USING AI TO ANALYZE DEALER CLIENT NETWORKS

The application of the real-time liquidity metrics to the RFX trading process must also account for the dealer chosen to host the transaction. For each dealer on the platform, LTX implements machine learning analytics that profile the trading patterns across the dealer’s client base based upon the dealer’s overall trading history. The key output of this model is a metric called Network Strength that captures the perceived level of interest in a specific trading opportunity.

Routinely, the model identifies one or more clients with significant interest in a potential trade, which has proven to be a strong predictor of actual trading behavior. Our testing has found that these signals produce rankings of the most likely buyers/sellers for a trade, achieving success rates of 75% or more. Applying these results to the LTX Liquidity Cloud, there is a clear benefit for a trader initiating an RFX to select a dealer who can bring in counterparties who are not only identified as strong Cloud Matches but also show up as strong candidates based upon the dealer’s overall trading activities.

LTX provides the dealers the option to incorporate these Network Strength factors in the liquidity metrics shared with their clients.

DRIVING SMARTER DECISIONS

The combination of this data science--Liquidity Cloud Scores, network analytics and Dealer Strength Scores--provides benefits to market participants and the credit market as a whole. Asset managers can initiate a trade with the knowledge that there is sufficient liquidity at their expected price and ask the best-equipped dealer to work their order (based upon that dealer's current and past performance). The dealer leverages their entire distribution network in addition to their sales team to efficiently connect the most highly probable clients to optimize a successful transaction.

As another Greenwich report noted, “To be fair, what this question doesn’t capture is how those liquidity providers decide whom to call or IB, what prices to bid or offer, and when it makes sense to commit capital to a given client or trade. Data and analytics from the trading venues, data providers and liquidity providers themselves drive much smarter decisions and allow orders to be more smartly worked, even if they are worked through legacy channels.” 4

RFX® TRADING

In combination with AI-assisted liquidity discovery, a trading protocol that facilitates transparency and price improvement is the last component to deliver the best possible outcome for all participants. RFX, the LTX trading protocol, allows each of the dealer’s clients to express their interest with a firm bid/offer for a desired size. Each bid/offer is transparent to the initiator of the trade, to the RFX hosting dealer, and to any of the other clients of that dealer who have submitted a bid/offer of their own. In this way, every participant benefits from price discovery. Each participant – including the originator – can improve their price based upon the contra interest they are seeing to arrive at the best market-clearing price.

DISCOVERING LIQUIDITY AND INCREASING TRANSPARENCY

Though corporate bond trading is increasingly moving towards electronic platforms, market structure issues cause this asset class to lag others. Liquidity scarcity continues to cause costly and time-consuming challenges for portfolio managers and traders. LTX is leveraging data science to discover natural liquidity and provide dynamic liquidity scores which indicate actual trading opportunities, along with a progressive trading protocol which delivers increased transparency with the ability for price improvement.

- https://www.cboe.com/us/equities/market_share/

- Rethinking How to Work a Bond Order | Coalition Greenwich. https://explore.broadridge.com/cm_ltx_greenwich/coalition-greenwich-

- Investing in Corporate Bond Liquidity: The Dealer View | Coalition Greenwich. https://www.greenwich.com/fixed-income/investing-corporate-bond-liquidity-dealer-view